Podcast (retirement-wisdom-podcast-feed): Play in new window | Download (Duration: 27:48 — 25.5MB)

Subscribe: Spotify | iHeartRadio | TuneIn | RSS | More

Retirement offers a great opportunity to reset. It opens up new possibilities with resources to do what you’ve always wanted to do. But how do you approach it? Christina Wallace, author of The Portfolio Life, knows how business frameworks can be used to design the life you want. For example, you likely have a diversified financial portfolio. It’s time to build a diversified life.

Christina Wallace joins us from Cambridge, Massachusetts.

_________________________

Bio

A self-described “human Venn diagram” Christina Wallace has crafted a career at the intersection of business, technology, and the arts. She is a Senior Lecturer in the Entrepreneurial Management Unit at Harvard Business School where she is co-course head for The Entrepreneurial Manager, teaches Launching Tech Ventures, and leads the MBA Startup Bootcamp immersion program. Her latest book, The Portfolio Life, was published by Hachette in 2023.

Previously, Christina was vice president of growth at Bionic, an innovation consulting firm that builds startups inside large enterprises. Prior to joining Bionic, Christina founded BridgeUp: STEM, an edtech startup inside the American Museum of Natural History, was the founding director of Startup Institute New York, and the co-founder and CEO of venture-backed fashion company Quincy Apparel. She was also, very briefly, a management consultant with the Boston Consulting Group and began her career at the Metropolitan Opera.

Christina holds undergraduate degrees in mathematics and theater studies from Emory University and an MBA from Harvard Business School. She is an active angel investor in early-stage tech startups as well as commercial theater productions on Broadway. She regularly speaks, writes, and consults on a wide range of topics, ranging from failure and resilience to corporate innovation, from K12 computer science education to her viral TED talk detailing her successful approach to hacking online dating. Mashable called her one of “44 Female Founders to Know” and Refinery29 named her one of the “Most Powerful Women in NYC Tech.” She has been featured in the Wall Street Journal, the Financial Times, Forbes, Inc, Fast Company, Quartz, Elle, and Marie Claire among others.

Christina is the co-author of New To Big: How Companies Can Create Like Entrepreneurs, Invest Like VCs, and Install a Permanent Operating System for Growth (April 2019, Penguin Random House). She also hosted The Limit Does Not Exist, an iHeartRadio podcast about portfolio careers that published 125 episodes over three seasons, garnering over 2 million downloads.

Podcast Episodes You May Like

The Power of Reinvention – Joanne Lipman

The Future You – Brian David Johnson

_____________________

Wise Quotes

Christina Wallace on a Portfolio Life in Retirement

“I think retirement, certainly as I’ve seen it with my mother-in-law, my friends’ parents, as they’re all going through this transition, they’re not like leaving the world. They’re just leaving that one thing that has been their big focus and has been their identity crucially for a really long time. And so it can be hard in that transition because not only have you lost the routine of what do I do with my day, you’ve also lost the community of here’s who I talk to on a regular basis – and then you’ve lost this identity. How do I describe myself? Who am I when I get out of bed? And as terrifying as it is to go through that transition and losing all three things at the same time, it’s a huge opportunity because for so many people at that cusp of retirement, they’re thinking, I’m not dead yet. I’ve got a whole life ahead of me. I still have something to offer. And very likely, I saw a lot of things I’m really curious about that I haven’t had space for. So rather than replacing one thing for another, the opportunity here is to really think about your portfolio, literally like your financial portfolio, and you map out what do I need for this chapter?”

On Identity

“So part of this work is before that decision to retire, right? It’s learning to separate your identity from your work and pulling up a level to say, Okay, who am I in any given room? What do I bring to the table? Am I a connector? Am I a storyteller? Am I someone who challenges the status quo? Am I someone who can read the room and can instantly notice when someone is feeling left out? And that shows up in how I am a leader, how I am a grandparent, how I volunteer in organizations. All of those things can be relevant to an identity. So doing that work before you quit, and then in that moment of that transition, that retirement experience, really thinking through what are all of the other translations of who I am in other spaces? What are other worlds, other rooms that want what I have to offer?”

On Building a Personal Board of Directors

“This is so crucial at each of these transition points, right? Your personal board of directors, as I described in the book, is having to stop thinking of that one mentor who’s going to give you all the answers, and instead, cultivate a portfolio of advisors, if you will, who each bring a specific thing, You go to one maybe for help on negotiating, you go to another who might be a super connector, they know everybody. They can help introduce you to different people. But you think through who’s that brain trust that I go to for advice? And as you go through transitions, one of my favorite things to advise is, is there someone new you need to bring into your brain trust to add a perspective that you might not be thinking through?”

_______________________

About Retirement Wisdom

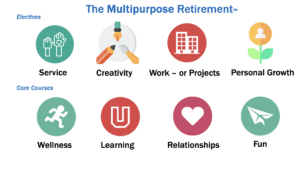

I help people who are retiring, but aren’t quite done yet, discover what’s next and build their custom version of The Multipurpose Retirement.™ A meaningful retirement doesn’t just happen by accident.

Schedule a call today to discuss how The Designing Your Life process created by Bill Burnett & Dave Evans can help you make your life in retirement a great one on your own terms.

About Your Podcast Host

Joe Casey is an executive coach who also helps people design their next life after their primary career and create their version of The Multipurpose Retirement.™ He created his own next chapter after a twenty-six-year career at Merrill Lynch, where he was Senior Vice President and Head of HR for Global Markets & Investment Banking. Today, in addition to his work with clients, Joe hosts The Retirement Wisdom Podcast, which thanks to his guests and loyal listeners, ranks in the top 1 % globally in popularity by Listen Notes, with over 1 million downloads. Business Insider has recognized Joe as one of 23 innovative coaches who are making a difference. He’s the author of Win the Retirement Game: How to Outsmart the 9 Forces Trying to Steal Your Joy.