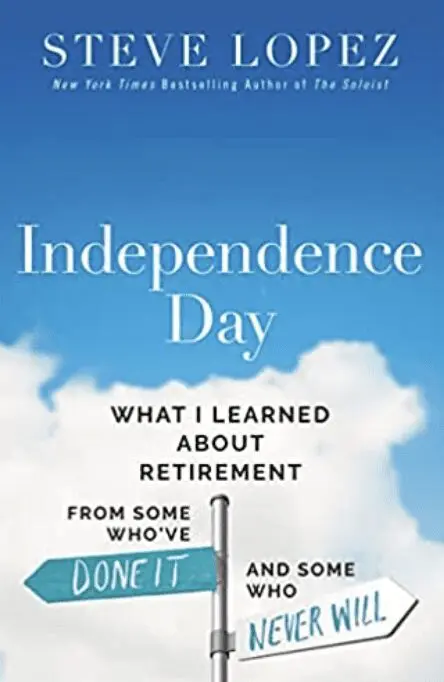

by Steve Lopez

One of the most vexing questions in retirement planning is a simple one. When should I retire?

A lot hinges on the answer. But as you ponder it, related questions spring up and your mind is suddenly a popcorn machine. When can I afford to retire? When do I want to retire? Do I really want to retire? What’s for lunch? What will I do in retirement? Should I just keep working? And on it goes.

Veteran LA Times columnist Steve Lopez, who’s been a finalist for the Pulitzer four times, turned his attention to this question in his new book Independence Day:What I Learned About Retirement from Some Who’ve Done It and Some Who Never Will.

As you’d expect an experienced journalist to do, he gave himself a deadline. One year- from one Fourth of the July to the next. He chronicles his experience of wrestling with the question of his own retirement and takes you inside the twists and turns that led to his decision.

Lopez uses his experience to interview people from different walks of life to explore what their experiences with retirement. Some of his conversations highlighted the joys of the freedom and flexibility retirement offers. But his interviews also revealed the pitfalls many people grapple with after leaving the world of full-time work, including loneliness, a loss of purpose, direction and structure. And he spoke with a number of people, including Mel Brooks and Norman Lear, about the path of continuing to work and never retiring.

Independence Day is an enlightening book that illuminates the multidimensional aspects of what at first appears to be primarily a financial decision. Lopez, through his own process of reflection, and his conversations with people on all sides of the retirement spectrum, offers a valuable window into several often overlooked dimensions of retirement, such as identity, spirituality, relationships, and creativity.

The book is a valuable resource for anyone who’s considering retirement. It demonstrates the power of self-reflection, the value of taking time to think things through, and how setting a deadline can help you come to a decision. Above all, it lays out a compelling case that there is no “right answer” on when – or how – to retire. So give yourself time to reflect on what your priorities are now. And take the initiative to reach out and talk to a range of people. It will help you get smarter about the various options and the joys and challenges people are experiencing in their version of retirement. It’s a matter of discovering the path that’s best for you – and it just might turn out to be a version you’re not considering – yet.

Highly recommend.

_________________________

Listen to my conversation with Steve Lopez on The Retirement Wisdom Podcast here.

Buy Independence Day:What I Learned About Retirement from Some Who’ve Done It and Some Who Never Will

Discover more Best Books on Retirement